A new record low for new home sales. One has to ask what is going to cause new home sales to increase. Sure inventories have dropped significantly, but what is going to cause a new home buying spree? Unemployment is menacing. The foreclosure, shadow inventory numbers are not good. Interest rates can't go markedly lower. So, where does that leave land prices. Here's a look at Seattle land values using the Land Residual Value Calculation. In the good 'ol days it worked something like this:

Home Price 300,000 100%

Construction costs 105,000 35%

Carry costs 30,000 10%

Selling Costs 30,000 10%

Land Improvements 45,000 15%

Gross Profit 45,000 15%

Raw Ground Value 45,000 15%

Case Shiller shows a 22% peak to current price decrease dropping the idealistic price example above to $234,000. The first to absorb this blow was the builder's gross profit expectation. The balance has been taken out on the Raw Ground Value dropping it to $30,600. A nasty 32% drop, jeopardizing the lenders original LTV of 70% to 75%. Another 10% to 15% dropped in home values will wipe out the value of the land on the builder's books. What's a builder to do? Another builder won't buy the land unless the profit is put back into the deal. Per the above calculation adding in a 15% gross profit takes another $35,000 from the land value taking it negative. So even without a further decline in home prices, raw ground is already underwater. The clever buyer would be looking to Bank REOs and be prepared to negotiate prices down with Subs, Suppliers & Agents.

Do you think it's not happening? Check out this article:

http://www.theolympian.com/2010/02/14/1137264/missing-headline-for-14obuildings.html

Here's the money quote:

“There are so many lots being flooded on the market right now that you can buy lots at or less than the cost of production,” he said. “Land values have essentially gone to zero.”

The Case Shiller has shown a pretty feeble pickup in prices during 2009, especially considering the total lack of interest in new homes as shown by the number of new homes sold in December.

The Case Shiller has shown a pretty feeble pickup in prices during 2009, especially considering the total lack of interest in new homes as shown by the number of new homes sold in December.

Rents are down over 20% (and going lower).

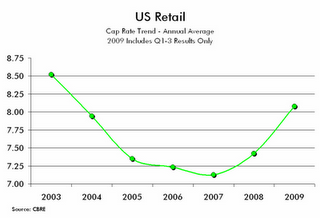

Rents are down over 20% (and going lower). Vacancies are up nearly 13% (and going higher). Capitalization rates are probably 300 bps higher (and as the meltdown continues, headed higher). Today our hypothetical building has probably lost over 50% of its value:

Vacancies are up nearly 13% (and going higher). Capitalization rates are probably 300 bps higher (and as the meltdown continues, headed higher). Today our hypothetical building has probably lost over 50% of its value:

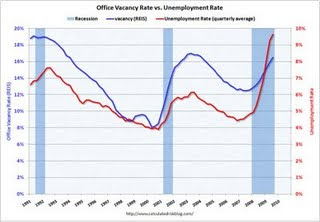

Nationwide Office vacancy rates are over 16%, after bottoming at 8%. Office vacancies appear to lag unemployment pretty closely. A top in unemployment will be a good confirmation of a coming low in office vacancies. The sharp increase in unemployment ensures that current leaseholders have ample room to house new employees prior to needing additional space, diminishing demand for office space.

Nationwide Office vacancy rates are over 16%, after bottoming at 8%. Office vacancies appear to lag unemployment pretty closely. A top in unemployment will be a good confirmation of a coming low in office vacancies. The sharp increase in unemployment ensures that current leaseholders have ample room to house new employees prior to needing additional space, diminishing demand for office space.