Tuesday, June 29, 2010

City Center Plaza

The price/sf exceeds what the Expedia Tower got, by quite a bit. It appears the market for leased up, Class A property in CBDs continues to strengthen buoyed by deep pocketed investors looking to take advantage of depressed market conditions. Of course, the coup of the decade still belongs to Northwest Mutual's steal of the WAMU Center last year. The lessons of WAMU Center are that it pays to look for a motivated Seller with a low cost basis (JP Morgan got it almost free as part of the Washington Mutual rescue, and, didn't want it) and have tenants waiting in the wings to move in (Northwest Mutual is the parent of Russell Investments who is moving into the tower).

Thursday, April 15, 2010

Hope Springs Eternal

Seattle's office towers stop getting emptier

Here's the money quote: " the total office-vacancy rate in greater downtown rose only fractionally during the first three months of 2010". I suppose that's a good thing unless you own a building. If you do, wouldn't you think it's the worst of times? The noose is about as tight as you can stand. From a valuation standpoint, vacancies need to stop increasing for values to stabilize. Hopefully, that's what's happening.Monday, February 15, 2010

A Tale of Two Towers - update

Let take a closer look at a hypothetical building in 2007. The major factors affecting the value of this building: rental rates, vacancies and capitalization rates were average for the market. Based on it's operating income of $70,000 it was valued at $1,000,000 as shown below:

Rental rate 100% of the market rate

Vacancy rate 7%

Operating Income $70,000

Cap Rate 7%

Cap Value $1,000,000

Since 2007, all factors affecting value have weakened.

Rents are down over 20% (and going lower).

Rents are down over 20% (and going lower).

Vacancies are up nearly 13% (and going higher). Capitalization rates are probably 300 bps higher (and as the meltdown continues, headed higher). Today our hypothetical building has probably lost over 50% of its value:

Vacancies are up nearly 13% (and going higher). Capitalization rates are probably 300 bps higher (and as the meltdown continues, headed higher). Today our hypothetical building has probably lost over 50% of its value:

Rental rates 80%

Vacancy rate 20%

Operating Income $44,800

Cap rate 10%

Cap value $448,000

Ouch! A 50% haircut. So, how do you beat the math in this trilema? Find an owner/occupant participant who can take on 50% of the available space, and, a building facing a 50% vacancy rate. Show a potential owner/occupant rental rates 20% lower than 2007 with an equity kicker and you probably have a partner.

A Tale of Two Towers

How was Northwestern Mutual able to get twice as much space for $53,000,000 less? Easy. WaMu Center's first sizeable tenant will be Northwestern owned Russell Investments. Prior tenants (Washington Mutual) were blown out by the finance crisis. On the other hand, Expedia leases 85% of Expedia Tower and is currently near full occupancy.

Note to Landlords: Don't lose tenants.

Note to Investors: Team up with a potential owner/occupant. If you can fill up half the space, the rest is almost free.

Saturday, October 31, 2009

CRE Prices

The 18 month lag between Residential & Commercial properties appear in tack this cycle. “If” the residential prices are near the bottom, then commercial ought to bottom next fall. Where might prices be then?

The 18 month lag between Residential & Commercial properties appear in tack this cycle. “If” the residential prices are near the bottom, then commercial ought to bottom next fall. Where might prices be then?Rents

Locally, office rents dropped sharply during the 3rd quarter. Cushman & Wakefield recently stated: “In downtown Bellevue, leases slid from $38.11 per square foot per year in the second quarter to $35.25. In downtown Seattle, they dropped from $33.23 to $31.90.” (http://seattletimes.nwsource.com/html/businesstechnology/2010001514_office05.html ). That’s 16% annualized in Bellevue, and, over 30% in Seattle. A continued drop in rents is baked in the cake. For example, Northwest Mutual’s purchase of the WAMU tower gives them a lot of space to rent, and a significant cost advantage. Undoubtedly they will offer lower rents that meet their target returns, but kill the whole market driving rents down.

A large nationwide CRE holder, Liberty Property Trust reported that: “For the third quarter rents decreased by 13.9%. We expect this third quarter experience to repeat itself for the balance of 2009 and for 2010. We are projecting that rents for 2010 will decrease by 10 to 15% on a straightline basis.” That would put rent decreases near 25% from their peak.

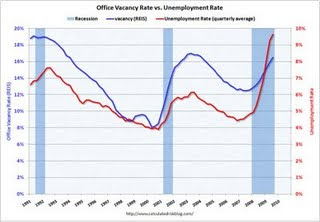

Nationwide Office vacancy rates are over 16%, after bottoming at 8%. Office vacancies appear to lag unemployment pretty closely. A top in unemployment will be a good confirmation of a coming low in office vacancies. The sharp increase in unemployment ensures that current leaseholders have ample room to house new employees prior to needing additional space, diminishing demand for office space.

Nationwide Office vacancy rates are over 16%, after bottoming at 8%. Office vacancies appear to lag unemployment pretty closely. A top in unemployment will be a good confirmation of a coming low in office vacancies. The sharp increase in unemployment ensures that current leaseholders have ample room to house new employees prior to needing additional space, diminishing demand for office space.Puget Sound vacancies are tracking the nationwide market.

Strip mall vacancies have no where to go but up. Take a quick drive thru your favorite strip mall and decide if 10% vacant is adequate.

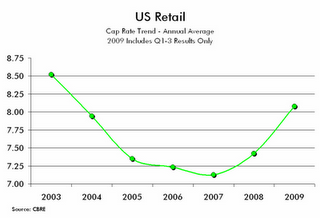

Cap Rates

Liberty Property Trust disclosed recent cap rates on actual sold office properties: “The cap rate on these sales will be in the 9 to 11% range.” These sales were negotiated early in the year. Do you think your local lender would be willing to lend based on a 10% cap rate, given their own problems? Not a chance, unless you have pile of money to put down at closing.

So where should CRE prices end up next year? Rents dropped precipitously during the 3rd quarter. Drops from peak pricing will be 20%. Vacancies haven’t seen a bottom yet, but so far have increased from about 7% to 16% in the Puget Sound. 20% vacancies will hit early next year. Capitalization rates have increased from 7% to at least 10%. Where does that leave prices?

Rental Rate 100% 80%

Vacancy Rate 7% 20%

Capitalization Rate 7% 10%

Operating Income $70,000 $47,600

Capitalized Value $1,000,000 $476,000

Ouch! A 50% haircut from the peak, even with generous assumptions. It is unlikely a stretched investor would be willing to accept a 50% haircut, since the LTV on the project was closer to 65%. How can they repay the loan? Rather, a short list of banks would probably be ecstatic to take the haircut on their loan, get some cash and help get the regulators off their backs.