Sales remain elevated...

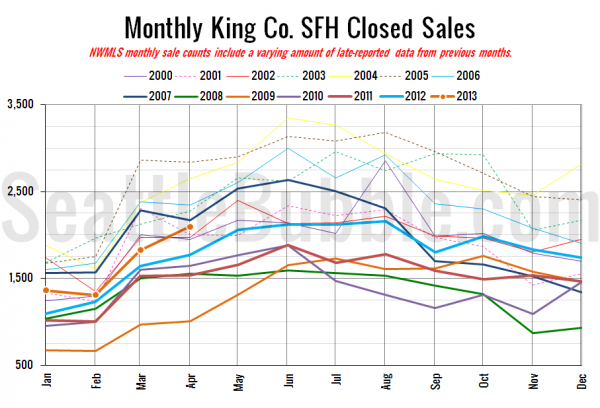

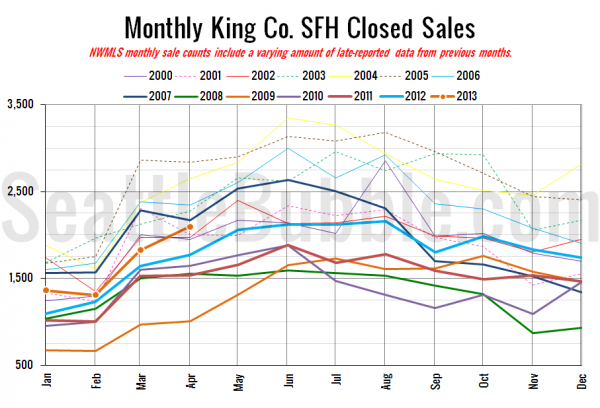

So far in 2013, King County Home Sales are well ahead of last year and are outpacing every year since 2008. Last month 2,096 homes were closed.

In the meantime...

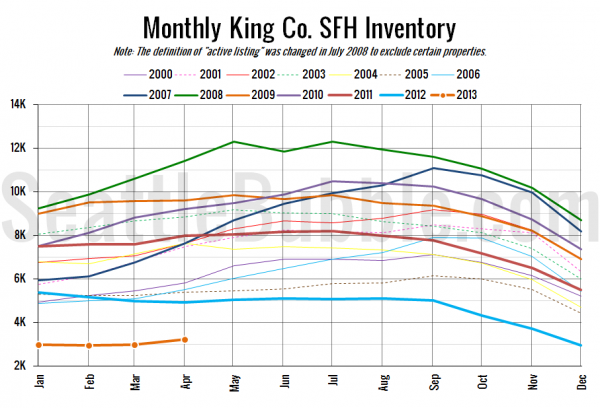

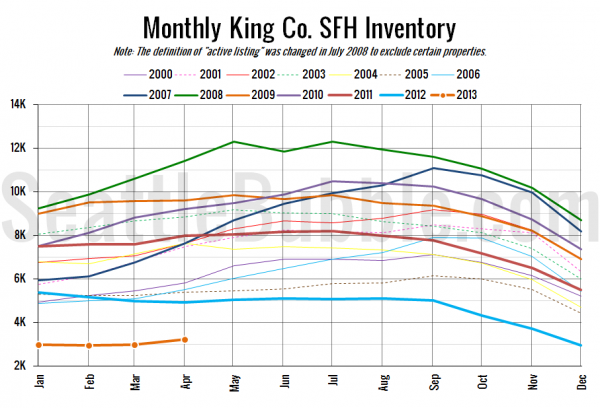

Inventory is at all-time lows. 3,221 homes are currently on the market. Inventory has remained steady since November of last year. The increase in sales must be coming from new listings. This is encouraging since it implies that the traditional move up buyer is coming back to the market. They appear to be putting their home on the market and buying another thereby being inventory neutral. Closed sales to inventory is at an extremely tight 1.5 ratio.

With demand for homes being greater this year and supply unusually low, what are prices doing...

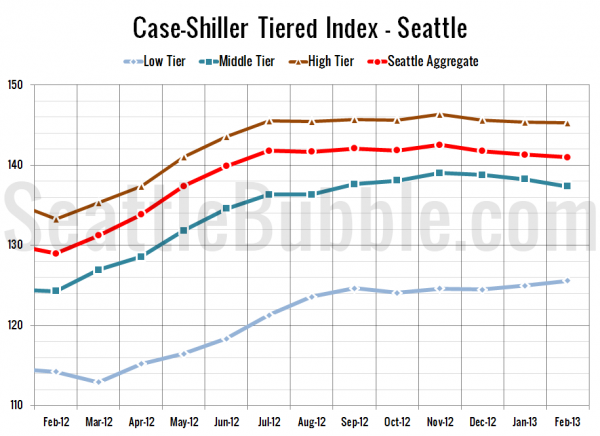

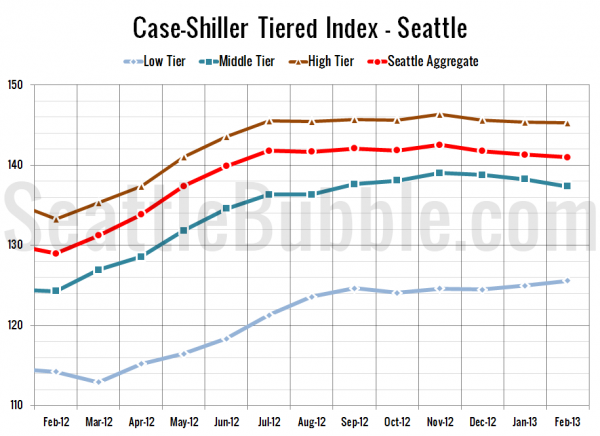

Surprisingly they have been basically flat since July 2012. Typically in the case of increased demand and tight inventory, price would do its job and move up to balance supply & demand. Of course, Case Shiller is a repeat sale index. Perhaps another view of prices is in order.

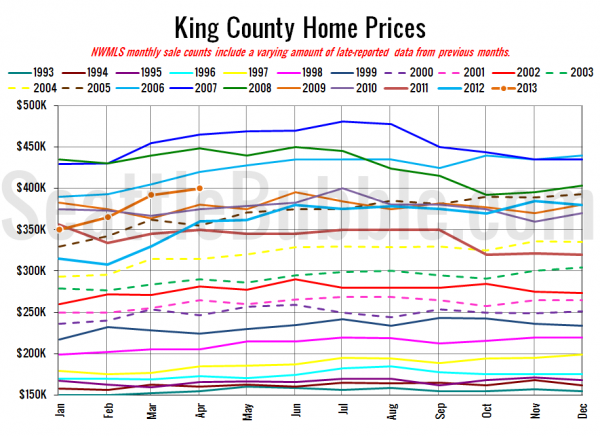

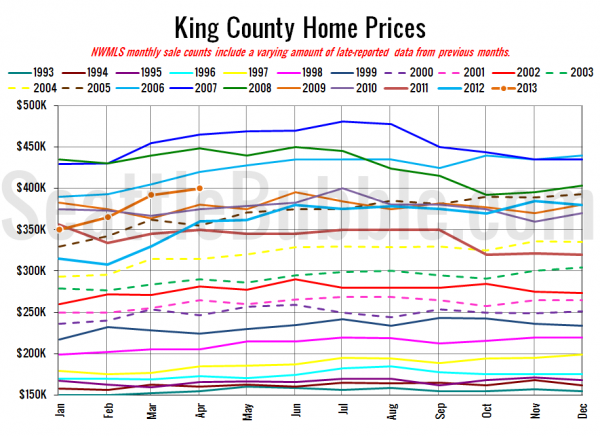

The median price of closed sales is currently higher than prices going back to 2009.

With Case Shiller being flat and median prices increasing, it would insinuate that higher priced homes sales are greater than they were last year. This might add some credence to the theory regarding the move up buyer.

Since I refuse to believe that the laws of economics have been repealed, what would need to happen to resolve this conundrum? Supply would need to increase without a commensurate increase is sales. That would suggest that one-sided sales such as foreclosures would need to increase.

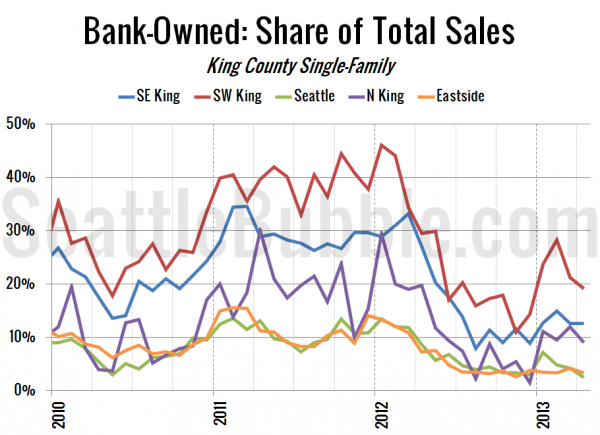

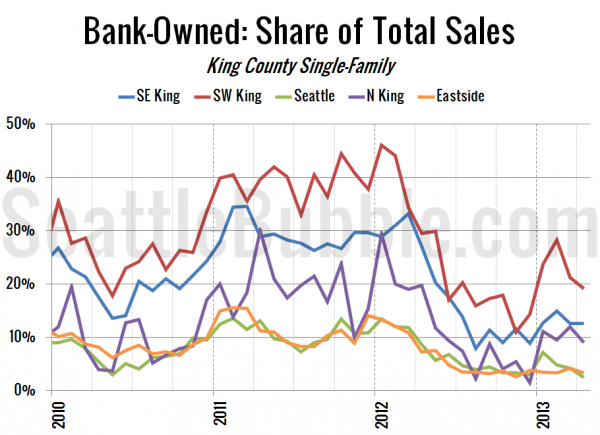

Bank owned sales spiked late last year, but nowhere near the peaks of 2011. I would expect further decreases in Bank owned sales. Many Banks have discovered the benefits of short sales in lieu of foreclosure. That trend should continue. So it doesn't seem that foreclosures will start a flood of inventory to the market. The other source of new inventory will come from new home builders. Anecdotal information suggests that the builders have been as surprised as anyone with the increase in sales and have been caught short of land. There is no landslide of new lots coming on due to builders.

What about demand...

One boost to demand has been low interest rates. While off their lows, the ten year note rate has been in a channel since the mid-2012 lows. A key pivot point is coming up in the next few weeks. A break of the upper trendline would signal higher rates. A reversal would argue for the opposite to happen. Anything in between is just noise. A decisive break up and out of the channel would certainly be detrimental to the market in terms of lower demand.

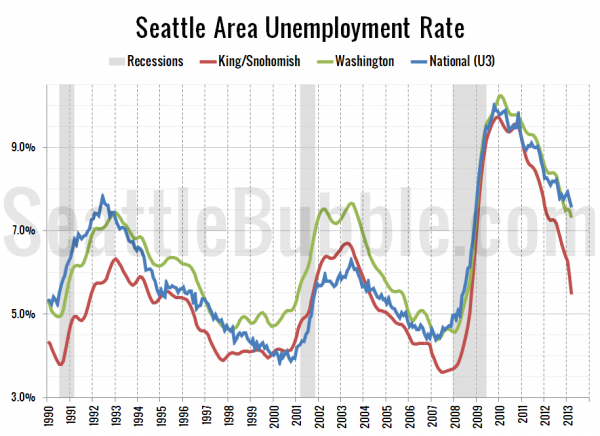

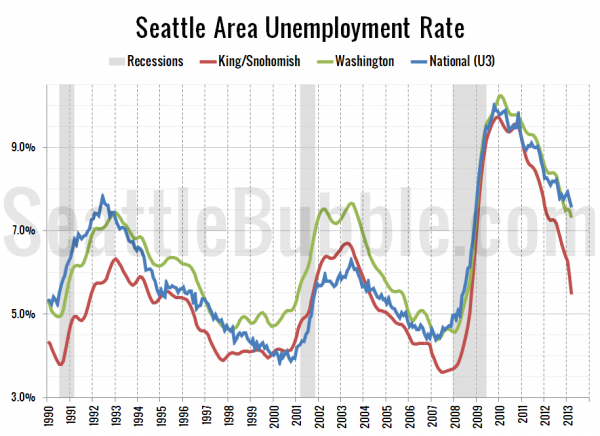

Another threat to demand is the number of unemployed people. King & Snohomish Counties have seen their unemployment rate plummet since the peak in 2010. While there are certainly many that are underemployed, or, would go back to work if they were handed a job, the trend is clearly towards lower unemployment levels. Seattle is actually within a stones throw of the tight labor markets of 2007 & 2000. The simple fact that the rate is dropping makes current employees more secure in their jobs, unlike 2009 which looked like there was never going to be any job creation. Unemployment doesn't appear to be a threat to housing demand.

Barring a sharp increase in rates, the only thing left for the market to do to reach equilibrium is for prices to increase. If this is indeed the situation then the lagging Case Shiller index should start showing increases soon. On Tuesday the March (3 month average of January, February & March) index will be released. I would suspect we'll start seeing the index moving up.

Most charts from Seattle Bubble.