Tumultuous week for the stock market starting with a vicious gap down Monday on S&P's downgrade of the US. By the end of the day the markets had regained a huge chunk of the initial drop. Strong earnings propelled the market higher by the end of the week.

The Dow Industrials became the 1st index to hit new highs for the year. The indicators are all pointing north. The Dow looks to be heading to its target of 130.

The S&P is lagging the Dow. Will need to see a new high shortly to confirm the Dow's breakout. Wave 3 had a nice 62% correction, while minor wave 1 had a reasonable 50% correction. This helps confirm the wave count. 142 still looks like a reasonable target.

The Naz 100 is also near a new 52 week high. The index took a nice leap off the 20 & 50 day ma's during the week. Need to see the breakout to confirm the move.

The Mid Caps also got a lift for the week leaving them close to new highs, also. The Mid Caps actually established a new high early in April. Hold high and 20 day ma should provide a safe entry point with the target at 107.

Russell 2000 also pointing higher. The indicators are supportive for a move to 92.

The Semiconductors were launched higher by Intel during the week. This is certainly supportive of the Naz target noted above.

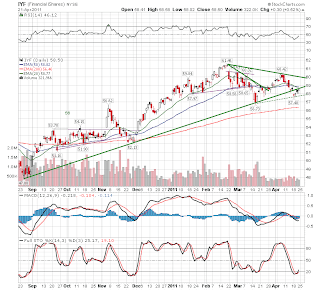

The financials have failed to contribute much to the market this year with an approximate 0% gain (about the same return you'd get on their CD offerings). The financials are up against their trendline with the 20 & 50 day ma's not far above. There are better places to look for opportunity outside of the financials.

Transports are struggling with high oil prices. They did set new highs in April, but gas prices could hinder further upside.

Should the Transports & Financials hold their own, the rest of the indices ought to proceed to their targets.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment