The February Case Shiller Home Price Indices were released this week. Seattle didn't fare too well.

Prices have fallen back to 2004 levels.

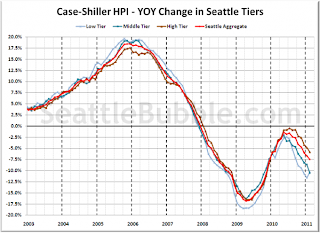

While the nationwide index has held fairly firm, Seattle prices resumed their downturn last Summer. Particularly the lower priced homes. I'd suggest this is due to lenders taking a more aggressive stance towards reducing their exposure to Real Estate.

The lower priced homes have lost 13% since last June. The high end has been spared tad. However, it is worth pointing out, that home prices have not since any appreciation since the end of 2007.

In order for any real estate market to recover, prices need to move to the point where the clear the market. In that sense, Seattle's market is trying to recover by finding the clearing price. At a certain point, lower prices draw in the "fundamental" buyers, helping to put a floor under prices. I don't think Seattle is there yet, but, it appears some "fundamental" buyers are being drawn in. Several large out of town home builders have made significant commitments to the Puget Sound area.

MDC Holdings purchased the assets of SDC staking a large position between Kent & Olympia.

Pulte/Centex took large positions at MPD's Snoqualmie Ridge & Redmond Ridge.

Newland took a stake in Cascadia.

Henley bought out Bennett.

Having the benefit of a longer term outllook, this outfits can wait out another year of falling prices and still make out like bandits. In the meantime, lower prices draw in investors which is a huge step in building bottom. Currently, lower prices have not drawn in retail home buyers suggesting that prices need to be even lower. I'm keeping an eye on sale volumes to see the price that is required to draw in buyers.

FOMC Preview: 25bps Rate Cut Expected

3 hours ago

No comments:

Post a Comment