Monday, November 2, 2009

Banks putting the squeeze on Developers

Banks foreclosing on Whatcom County's unsold condo projects

http://www.thenewstribune.com/news/northwest/story/927549.html

Chapter 11 for Cascadia

http://www.thenewstribune.com/topstories/story/919317.html

Seattle developer Mastro has huge debts, bankruptcy papers show

http://seattletimes.nwsource.com/html/localnews/2009843640_mastro11.html?prmid=obnetwork

Frontier Bank sues Edmonds developer over $40 million in unpaid loans

http://www.heraldnet.com/article/20091016/BIZ/710169861

The following Banks were mentioned in the articles:

Horizon Bank

Bank of the Pacific

Whidbey Island Bank

Seattle Bank

Columbia State Bank

First Sound Bank

Venture Bank

HomeStreet Bank

Frontier Bank

Guess what many of these banks have in common?

Check the Troubled Bank List at Calculated Risk.

http://www.calculatedriskblog.com/2009/10/unofficial-problem-bank-list-grows-to.html

Regulators are putting the screws to many of the Banks pressing foreclosure.

Horizon Bank _______3/3/09 _____Cease & Desist

Bank of the Pacific

Whidbey Island Bank

Seattle Bank ________6/08/09 ____Cease & Desist

Columbia State Bank

First Sound Bank

Venture Bank _______9/11/09 _____Failed

HomeStreet Bank ____5/08/09 _____Cease & Desist

Frontier Bank _______3/20/09 ____Cease & Desist

I imagine they would also fit the classic definition of “motivated sellers.”

Saturday, October 31, 2009

CRE Prices

The 18 month lag between Residential & Commercial properties appear in tack this cycle. “If” the residential prices are near the bottom, then commercial ought to bottom next fall. Where might prices be then?

The 18 month lag between Residential & Commercial properties appear in tack this cycle. “If” the residential prices are near the bottom, then commercial ought to bottom next fall. Where might prices be then?Rents

Locally, office rents dropped sharply during the 3rd quarter. Cushman & Wakefield recently stated: “In downtown Bellevue, leases slid from $38.11 per square foot per year in the second quarter to $35.25. In downtown Seattle, they dropped from $33.23 to $31.90.” (http://seattletimes.nwsource.com/html/businesstechnology/2010001514_office05.html ). That’s 16% annualized in Bellevue, and, over 30% in Seattle. A continued drop in rents is baked in the cake. For example, Northwest Mutual’s purchase of the WAMU tower gives them a lot of space to rent, and a significant cost advantage. Undoubtedly they will offer lower rents that meet their target returns, but kill the whole market driving rents down.

A large nationwide CRE holder, Liberty Property Trust reported that: “For the third quarter rents decreased by 13.9%. We expect this third quarter experience to repeat itself for the balance of 2009 and for 2010. We are projecting that rents for 2010 will decrease by 10 to 15% on a straightline basis.” That would put rent decreases near 25% from their peak.

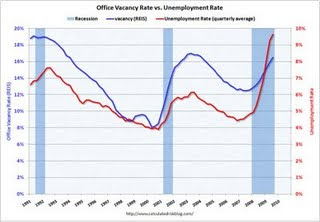

Nationwide Office vacancy rates are over 16%, after bottoming at 8%. Office vacancies appear to lag unemployment pretty closely. A top in unemployment will be a good confirmation of a coming low in office vacancies. The sharp increase in unemployment ensures that current leaseholders have ample room to house new employees prior to needing additional space, diminishing demand for office space.

Nationwide Office vacancy rates are over 16%, after bottoming at 8%. Office vacancies appear to lag unemployment pretty closely. A top in unemployment will be a good confirmation of a coming low in office vacancies. The sharp increase in unemployment ensures that current leaseholders have ample room to house new employees prior to needing additional space, diminishing demand for office space.Puget Sound vacancies are tracking the nationwide market.

Strip mall vacancies have no where to go but up. Take a quick drive thru your favorite strip mall and decide if 10% vacant is adequate.

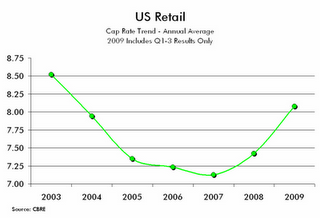

Cap Rates

Liberty Property Trust disclosed recent cap rates on actual sold office properties: “The cap rate on these sales will be in the 9 to 11% range.” These sales were negotiated early in the year. Do you think your local lender would be willing to lend based on a 10% cap rate, given their own problems? Not a chance, unless you have pile of money to put down at closing.

So where should CRE prices end up next year? Rents dropped precipitously during the 3rd quarter. Drops from peak pricing will be 20%. Vacancies haven’t seen a bottom yet, but so far have increased from about 7% to 16% in the Puget Sound. 20% vacancies will hit early next year. Capitalization rates have increased from 7% to at least 10%. Where does that leave prices?

Rental Rate 100% 80%

Vacancy Rate 7% 20%

Capitalization Rate 7% 10%

Operating Income $70,000 $47,600

Capitalized Value $1,000,000 $476,000

Ouch! A 50% haircut from the peak, even with generous assumptions. It is unlikely a stretched investor would be willing to accept a 50% haircut, since the LTV on the project was closer to 65%. How can they repay the loan? Rather, a short list of banks would probably be ecstatic to take the haircut on their loan, get some cash and help get the regulators off their backs.

Naz 10-09

Thursday, October 29, 2009

US Dollar

SP 500

This looks like a good place to sell. Shorting at 1060 with stops near 1075-1080 ought to work.

This looks like a good place to sell. Shorting at 1060 with stops near 1075-1080 ought to work.

Monday, October 19, 2009

S&P 10/09

Saturday, October 17, 2009

NAZ Long Term

Nearing the top of a wedge near the target area. It's going to need to make a jump in the next week or so for the target to get hit. It will probably take some robust earning to get it over the bar.

Nearing the top of a wedge near the target area. It's going to need to make a jump in the next week or so for the target to get hit. It will probably take some robust earning to get it over the bar.Gold

Long term holders should hold. This has a long ways to go.

Long term holders should hold. This has a long ways to go.Saturday, September 5, 2009

Dow Short Term

Lumber Update

China

5 Year Treasuries

Gold - Long Term

NAZ Long Term

Saturday, August 29, 2009

Lumber

Critical juncture for Lumber. After two failed attempt to break its longer term downtrend, Lumber is back knocking on the uptrend of its fledgling 2009 rally.

Critical juncture for Lumber. After two failed attempt to break its longer term downtrend, Lumber is back knocking on the uptrend of its fledgling 2009 rally. Oops! Not looking good for lumber here. Taking a closer look it appears 178 will be tough resistance to break thru. A short would put a stop in at 182 while looking for a target of 150 setting up a longer term double bottom. Appears lumber traders think new home starts won't pick up until Spring 2010. They're probably correct on that count.

Oops! Not looking good for lumber here. Taking a closer look it appears 178 will be tough resistance to break thru. A short would put a stop in at 182 while looking for a target of 150 setting up a longer term double bottom. Appears lumber traders think new home starts won't pick up until Spring 2010. They're probably correct on that count.Used Home Inventories July '09

Used Home Sales July '09

After stablizing, used home sales are actually picking up. Desperate sellers and eager investors/1st time buyers are providing some much needed liquidity to the marketplace. Appears sales volumes won't much below 3,500,000. This is great news for transaction based market players who downsized during the downturn. Escrow, title insurers, agents and low end builders should be looking at strategies to increase their market share.

After stablizing, used home sales are actually picking up. Desperate sellers and eager investors/1st time buyers are providing some much needed liquidity to the marketplace. Appears sales volumes won't much below 3,500,000. This is great news for transaction based market players who downsized during the downturn. Escrow, title insurers, agents and low end builders should be looking at strategies to increase their market share.Case Shiller Prices June '09

Prices aren't dropping as fast as they were. Investors and 1st time buyers are providing a much needed floor on low end prices. Investors may have deep pockets and continue to support the market. 1st time buyer pent up demand will wane as the tax credit expires. Builders and their lenders desparately need prices to stop dropping in order to curb their losses. Low end builders may be nearing this point. High end builders will continue to bleed. Take your losses this year in order to be competitive in the marketplace.

Prices aren't dropping as fast as they were. Investors and 1st time buyers are providing a much needed floor on low end prices. Investors may have deep pockets and continue to support the market. 1st time buyer pent up demand will wane as the tax credit expires. Builders and their lenders desparately need prices to stop dropping in order to curb their losses. Low end builders may be nearing this point. High end builders will continue to bleed. Take your losses this year in order to be competitive in the marketplace.Ugh. Deduct closing costs and the average is back at 2002 prices. Tough spot for any high LTV buyer or refi'er to be in. Each uptick in pricing is going to be met with new listings from those high LTV'ers who've found an acceptable price point to unload their home. There will be no "V" shaped price recovery. Hockey stick to come.

Nationwide New Home Inventory 709

The inventory liquidation continues. New home inventories have been halved during 2009. Difficulty in financing standing inventory is going to continue to pressure inventory levels. Getting down to 200,000 would be supportive to pricing.

The inventory liquidation continues. New home inventories have been halved during 2009. Difficulty in financing standing inventory is going to continue to pressure inventory levels. Getting down to 200,000 would be supportive to pricing. Even with the a halving of inventory levels, months supply is still too high for the current environment. Months supply needs to backoff to 5 before pricing can firm up. August thru mid-October sales will tell the tale.

Even with the a halving of inventory levels, months supply is still too high for the current environment. Months supply needs to backoff to 5 before pricing can firm up. August thru mid-October sales will tell the tale. Nationwide New Home Sales July '09

chart from http://www.calculatedriskblog.com/

Spurred by the tax credit, low mortgage rates and lender pressure on builders, nationwide new home sales showed some seasonal strength improving over June. Still, it's the 3rd slowest July sales since 1963. With the tax credit expiring at the end of November, new home sales (& used home sales) should show relative strength thru mid October. Builders would be well served to use the opportunity to further liquidate inventories. With nearly 1 in 10 workers unemployed and 1st time buyer pent up demand being used up, the future is not so clear.

Dr Copper

Oil recently tagged its 50ma and is looking to jump its neckline. Tight risk/reward with stops below the 50.

Oil recently tagged its 50ma and is looking to jump its neckline. Tight risk/reward with stops below the 50.